If you’re a homeowner in Canada, chances are you’ve received one of those friendly emails or letters from your bank/lender saying, “Hey, great news! You’re eligible to renew your mortgage early.”

Sounds like a win, right?

Well… sometimes it is. But other times, it’s a clever move by the bank that could cost you thousands over the life of your mortgage. So let’s break down how these early renewal offers work, when you should consider accepting one, and when it’s better to shop around, or hold off entirely.

First Off… What Is an Early Renewal?

An early renewal is when your lender offers you the chance to lock in a new mortgage term before your current one ends—typically within the final 4 to 6 months of your term. As an example, if you took a 3 year fixed which is up for renewal/maturity on December 1st, 2025, some banks may reach out to offer to renew you out as early as August, 2025. If you opt for this, you are locked in to the new rate effectively immediately. This means that you are now in a new mortgage term/rate effective August 2025, not December 1st anymore.

Keep in mind that there’s no penalty, but that’s only true if you’re staying with them. But it’s important to remember: locking in early cuts your current term short—whether that helps or hurts depends on where rates are now versus where they were when you locked in.

What a Typical Early Renewal Offer Looks Like

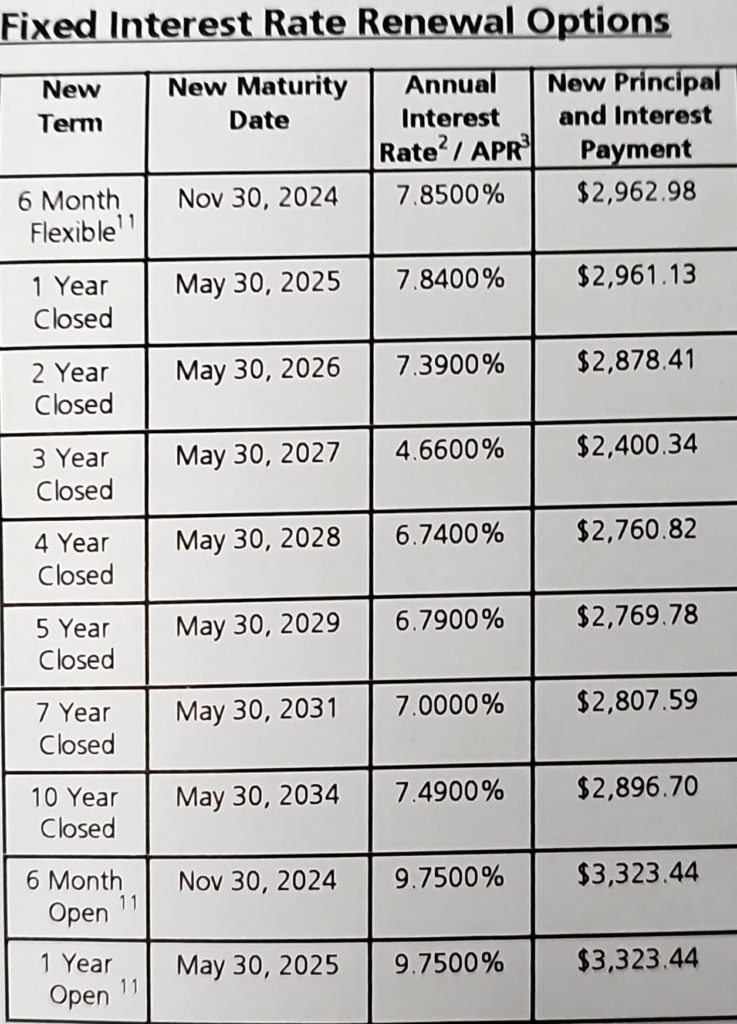

Here’s a real-world example of what an early renewal letter might look like:

This kind of chart lays out your options for term lengths, interest rates, and new monthly payments. And as you can see, the differences are massive—$2,400/month vs. $2,961/month depending on which term and rate you go with.

How Early Can You Renew?

Here’s a quick cheat sheet on how early the major Canadian banks allow you to renew with no penalty (as long as you stay with them):

- RBC – 180 days

- BMO – 180 days

- CIBC – 150 days

- Scotiabank – 6 months

- National Bank – 6 months

- TD – 120 days

That’s up to half a year early—so it’s no surprise that lenders will start nudging you well before maturity. If you have a mortgage with a monoline lender or credit union, the early renewal is typically 120 days,

When It Makes Sense to Renew Early

You’re currently in a high interest rate term—maybe something like 6.5% or even 7%—and the bank is offering something significantly lower.

If rates have come down and you’re able to lock in a better deal, it might be worth renewing early to capture savings sooner. It’s especially worthwhile if you plan to ride that new rate for a full term.

When It Doesn’t Make Sense

This is the trap a lot of people fall into: you locked in a super-low rate a few years ago, and now rates are higher… but the bank is encouraging you to “renew early” into something worse.

In that case, you’re giving up months of low payments just to get into higher ones sooner. Unless there’s a big reason to refinance, it’s often better to ride out your current term.

When to Shop Around

Your bank’s offer might not be the best available—especially if you’ve been with them a while.

A broker can help you compare renewal options across multiple lenders. Sometimes just shopping around or asking your current lender to match a competitor’s rate can save you thousands. Keep in mind that if you are coming out of a lower rate, you should still shop around and secure a rate hold. You do not know whether your current lenders offer might increase a month out from your renewal date if you are deciding to hold on to your low rate for as long as possible. Early renewal offers are only valid for a very short period before they expire. Locking in somewhere else will at least protect you from increases, as well as still allowing you to take advantage of lower rates.

What If You Want to Restructure?

Another good reason to not early renew is if you’re planning to make structural changes to your mortgage at renewal:

- Consolidating other debts into your mortgage, such as a home equity line of credit or unsecured debts

- Increasing or decreasing your amortization to lower/increase your monthly payments

- Tapping into equity for renovations or investments

Early renewal offers usually just continue what you current have in terms of mortgage structure, so if you want to make a strategic change, it may be better to wait.

Final Thoughts

An early renewal might save you money—or cost you. It all depends on your current rate, the offer on the table, and your future plans. While lenders open room for negotiation on early renewal rates, they are not always the most aggressive, depending on whether you are coming out of a higher rate or a lower one.