Up for Renewal?

If the term of your mortgage loan is ending and you haven’t paid off your mortgage loan in full, you’ll be looking to renew.

You may be able to reset everything: the term, principal and interest payment amount and frequency – and start fresh. This makes a mortgage renewal a great time to take a look at your overall financial position, note any changes and make adjustments accordingly.

Chances are a lot has happened in your life since you got your mortgage loan. Maybe your income has changed or perhaps your family has grown. This is a great time to talk to our experts about ways to reduce your monthly principal and interest payment, lower your cost of borrowing, or pay your mortgage loan off sooner.

At the Mortgage Architects we will leverage our relationship with over 100+ Lenders to ensure you get the best deal on renewal.

When to renew:

120 days from maturity

It’s a good idea to write your mortgage renewal date on a calendar, then count back 120 days (4 months) and start your renewal process then. Lenders may let you renew your mortgage loan 120 days before maturity early without you having to pay a prepayment charge.

- Contact our experts at least 120 days before your mortgage loan matures.

- Re-evaluate your financial position and goals.

- Explore rates, terms and features between various lenders.

- Choose the mortgage loan that best fits your needs

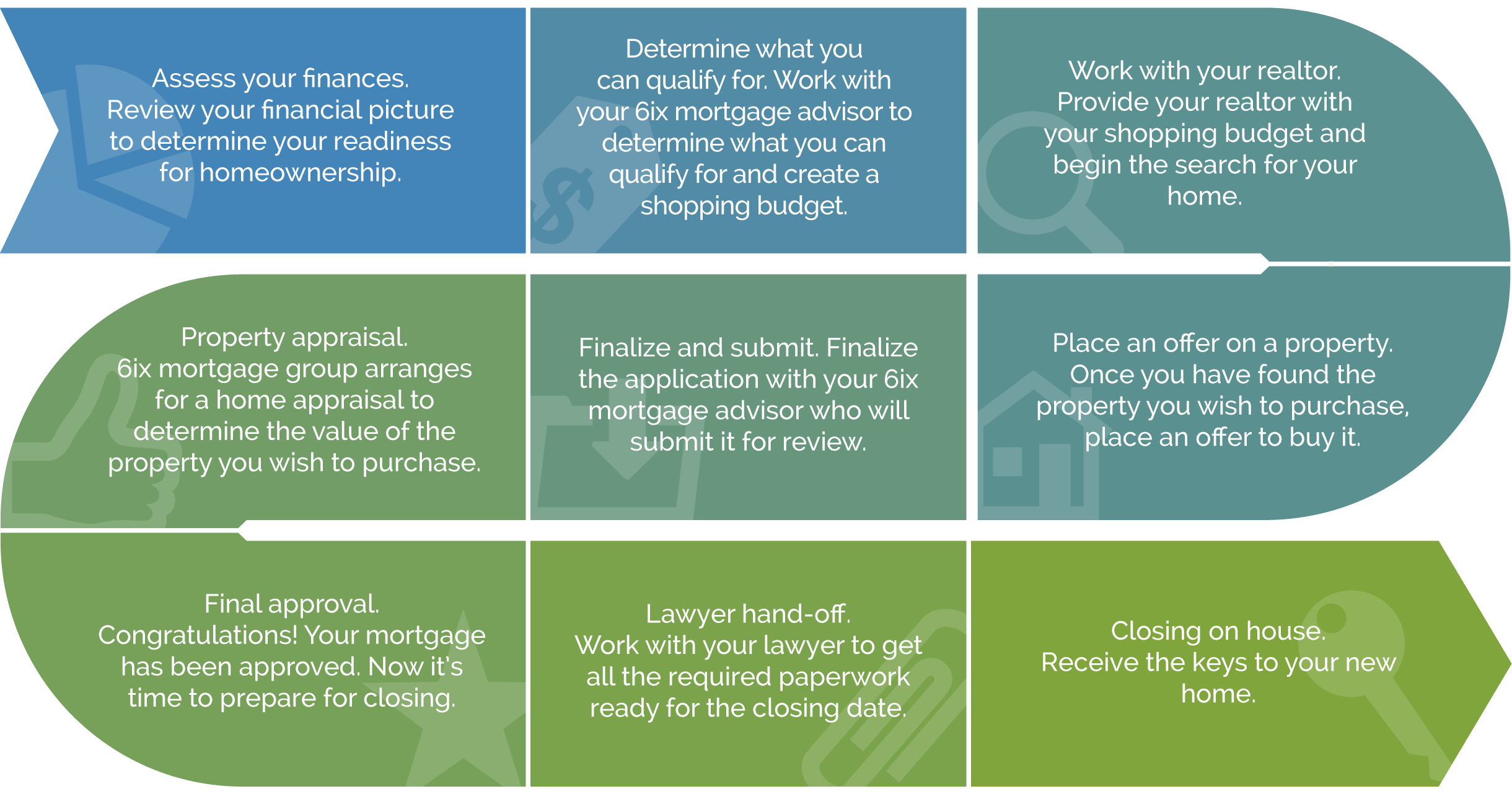

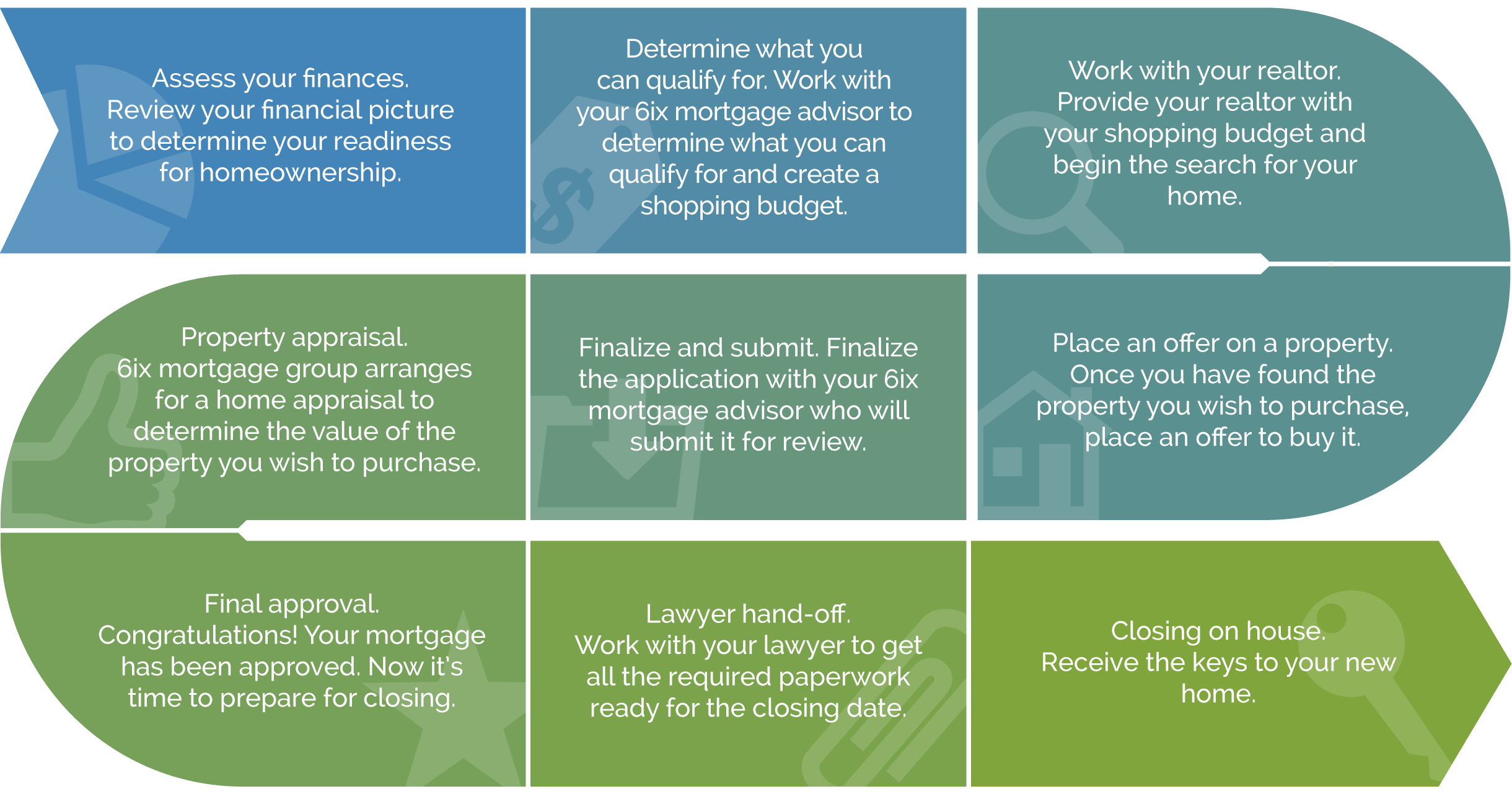

THE HOME BUYING PROCESS

Required Mortgage Documents Checklist

- Current employment and amount of income such as:

- Copy of recent pay slips

- Evidence of recent pay deposited electronically

- T1 General and associated Notice of Assessment (NOA)

- Previous employment (if required)

- Additional income sources (if any)

- Savings or investments statement from within the last 90 days

- Sale of an existing property – a copy of the sale agreement

- Withdrawal from RRSP through the Home Buyer’s Plan, if applicable

- Gift Letter

- A list of current assets and liabilities

- Bank account and transit number for payments

- Your CIBC Pre-Approved Mortgage Certificate, if applicable

- A copy of the real estate listing

- A copy of the accepted purchase and sale agreement

- The property’s full address, including legal description and postal code

- Property tax estimates, condo fees and heating costs, (usually available on the real estate listing)

- For rural properties, well and septic certificates

- Lawyer’s name, address, postal code, telephone and fax number