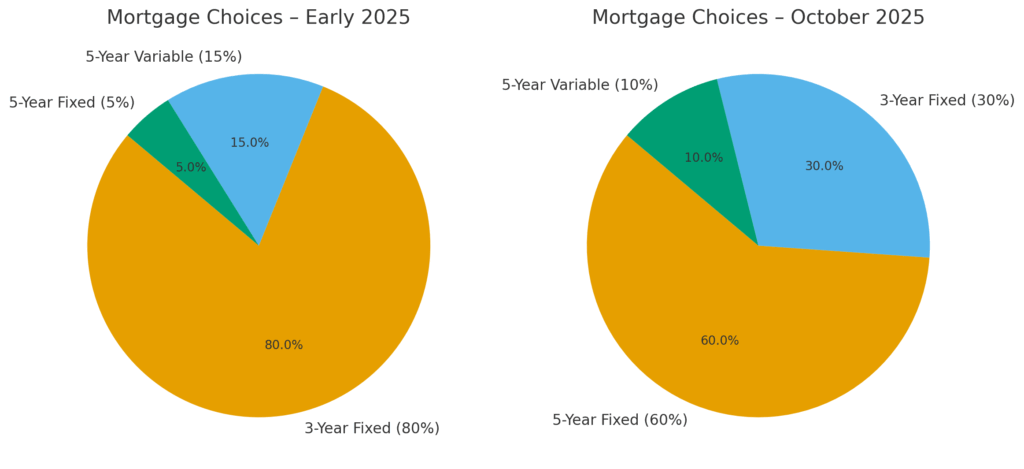

At the start of 2025, most Canadians were leaning towards short term fixed rates. Roughly 80% of our clients were locking into 3 year fixed mortgages, with only 15% choosing 5-year variables and just 5% opting for 5-year fixed terms.

As we near the end of the year, those numbers have flipped dramatically. Based off our stats today, 60% of borrowers are going with a 5-year fixed, 30% are still taking 3 year fixed, and 10% are choosing 5 year variable.

In this blog, we will examine the trends we have seen, as well as the common reasonings behind them from talking to our clients. Note that this is NOT an article on fixed vs variable, or what term to select, rather an interpretation of our findings this year from speaking to our clients.

(See charts above for a breakdown of the shift.)

What Changed?

The biggest factor has been the drop in the prime rate. After a series of rate cuts, prime now sits at 4.70%, with economists projecting another 0.50% in cuts throughout 2025. While that might sound like a win for variable rate borrowers, most Canadians are still choosing stability over risk.

Even though variable rates could drift lower, the peace of mind of a guaranteed 5-year fixed rate, especially one under 4%, is hard to pass on. Keep in mind that borrowers who took a variable rate in 2021 in the 1.5-2% range had their rates shoot up to 5.5%+. It seems to be the case that these borrowers no longer want to face any more unforeseen economic changes that could potentially variable rates up again. To put simply, borrowers seem fatigued of having to deal with such large and unforeseen economic changes and how they would impact variable rates(both in the short term and long term).

Why the Shift Away from 3-Year Terms?

Earlier in the year, 3-year terms were the sweet spot: short enough to wait out high rates, long enough to avoid constant renewals. But now, with 5 year fixed rates similar to 3 year options, the math and psychology have changed.

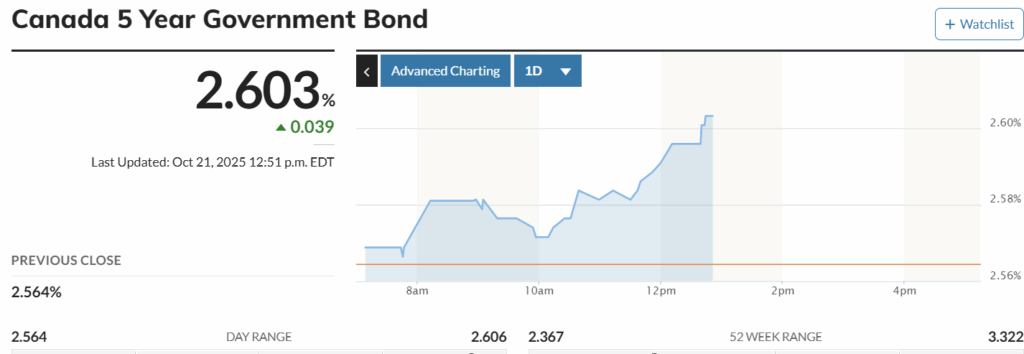

Many homeowners are looking at global uncertainty, especially with U.S. elections coming up again in roughly three years, and deciding that a little extra term length is worth the stability. Case in point, as of writing this article today, annual inflation rose to 2.4% in September, with bond yields shooting back up again by 0.06%.

Bottom Line

If you can lock in a 5-year fixed rate under 4%, you’re in an excellent position. You’ll gain predictability and protection against future volatility, while still benefiting from historically low fixed-rate levels. As always said, the longer the duration of the term, the less risk imposed on the borrower. 5 year fixed terms will be less risky than a 3 year fixed term.