Just a few weeks ago, we were seeing 5-year high-ratio fixed rates as low as 3.74%. Since then, those rates have quietly crept up by 10 to 20 basis points. And it’s not just insured mortgages—uninsured (conventional) fixed rates are inching up too.

At the same time, variable-rate discounts are getting slimmer. Some of the big banks, like CIBC and Scotiabank, have trimmed how much of a discount they’re knocking off the current 4.95% prime rate. In other words, their variable-rate offers aren’t quite as generous as they used to be. Where we saw as low as prime – 0.95% on a 5 year variable, the best in the market now hovers around Prime – 0.85% depending on your situation.

But why the shift?

With the current trade uncertainty looming, bond yields have been zig zagging, with the 5 year bond up from 2.466% on April 4th, to 2.788% as of today(May 8th). This has put upward pressure on fixed rates, with several banks and lenders increasing their fixed rates in the past 2 weeks.

Noting that variable rates are becoming more popular as they catch up to the spread difference between fixed rates, lenders of course want to increase their profitability now, and so reducing the discount they offer off prime is the easiest way to go about it.

Why Variable Rates Still Have Room to Fall

Even though variable-rate discounts are tightening, that doesn’t mean the actual rates themselves can’t drop further. In fact, many in the industry still expect them to.

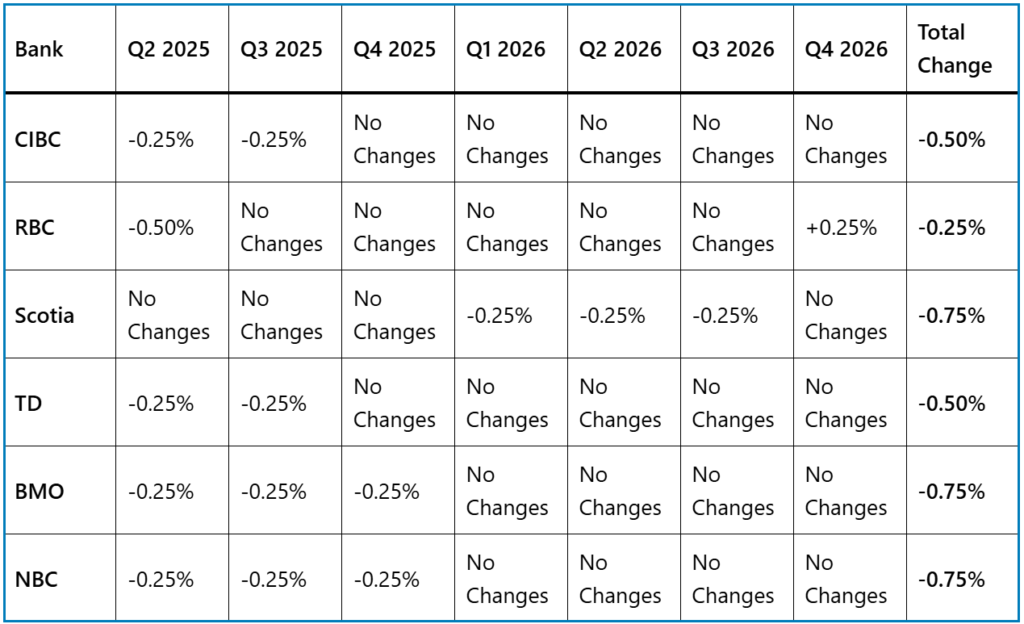

Here are the latest bank forecasts for the prime rate:

On average, we can expect up to 0.50% in further cuts based on current projections. Keep in mind that this is based on data available today, and could drastically change over time depending on the ever changing economic conditions.

So Fixed or Variable?

When it comes to picking the right product, the truth is that several factors play a major role in determining the right product for you.

🔒 Fixed Rate Might Be Better If You:

- Prefer predictable, stable monthly payments

- Would stress over rate increases

- Have tight room in your monthly budget

- Plan to stay in your home for the full mortgage term

- Don’t want to think about market changes

🔄 Variable Rate Might Be Better If You:

- Can handle some payment fluctuations

- Believe rates will drop or stay low

- Want lower penalties if you break the mortgage early

- Have flexibility in your income/budget

- Like the option to lock into a fixed rate later

If you ask me to just compare apples to apples over a 5 year cost of borrowing horizon, I would personally think that the variable comes out ahead in comparison to a 5 year fixed rate. With the potential for further rate cuts on the variable, this gives a lot of downside potential in interest savings for variable rate holders.

Keep in mind that just because variable rates have a chance to drop further, does not mean fixed rates will drop too. Fixed rates move independently to variable rates, primarily based on the bond yields.

Our Take? For First Time Buyers, Grab a High-3% Fixed While You Can

If you can still snag a 2-5 year fixed rate that starts with a 3, it’s worth serious consideration. Just two years ago, borrowers would’ve jumped at a rate under 4%. I feel that for a first time buyer, predictability and security is key, especially when juggling the biggest debt of their life for the first time. In this case, a fixed rate lets you know exactly what your payments are going to be each month, which makes budgeting much easier. You also won’t have to worry about market trends and which way variable rates may go.

That said, if you’re expecting a big life change—like selling your home or moving in the next couple of years—a variable might make more sense simply because of the lower penalties and extra flexibility. Another thing to keep in mind is that you can convert a variable into a fixed rate at anytime, without incurring any penalties or triggering a new mortgage application to do so. You can simply call up your existing lender and ask what they are offering to convert you into a fixed rate.

Key Takeaways

- Fixed mortgage rates are on the rise, with 5-year high-ratio rates up 10–20 bps in recent weeks.

- Variable-rate discounts are shrinking, with fewer lenders offering deep discounts off prime.

- Bond yields are climbing, putting pressure on fixed rates to go higher.

- Despite smaller discounts, variable rates still have room to fall if the Bank of Canada follows through with projected rate cuts.

- Bank forecasts suggest up to 0.50-0.75% in further prime rate cuts by the end of 2026.

- Fixed rates offer stability, while variable rates offer flexibility and lower penalties—especially useful if you might move or refinance soon.

- If you can lock in a high-3% fixed rate, it’s worth strong consideration while they’re still around.