High-interest debt from credit cards or loans can make it hard to manage your finances. But if you’re a homeowner, you can take advantage of your home’s equity. Combine the money you owe into a debt consolidation mortgage, home equity loan or line of credit.

High-interest debt from credit cards or loans can make it hard to manage your finances. But if you’re a homeowner, you can take advantage of your home’s equity. Combine the money you owe into a debt consolidation mortgage, home equity loan or line of credit.

What’s debt consolidation?

Debt consolidation is debt financing that combines 2 or more loans into one. A debt consolidation mortgage is a long-term loan that gives you the funds to pay off several debts at the same time. Once your other debts are paid off, it leaves you with just one loan to pay, rather than several.

To consolidate your debt, we establish a new mortgage for the total amount you owe. Consolidation is particularly useful for high-interest loans, such as credit cards.

Increase cash flow

Using a mortgage to pay off high interest debts such as loans and credit cards will most likely increase your cash flow. Mortgages can be amortized up to 30 years and the debit being consolidated will result in much lower payments. Talk to one of our experts to determine if debt consolidation is right for you.

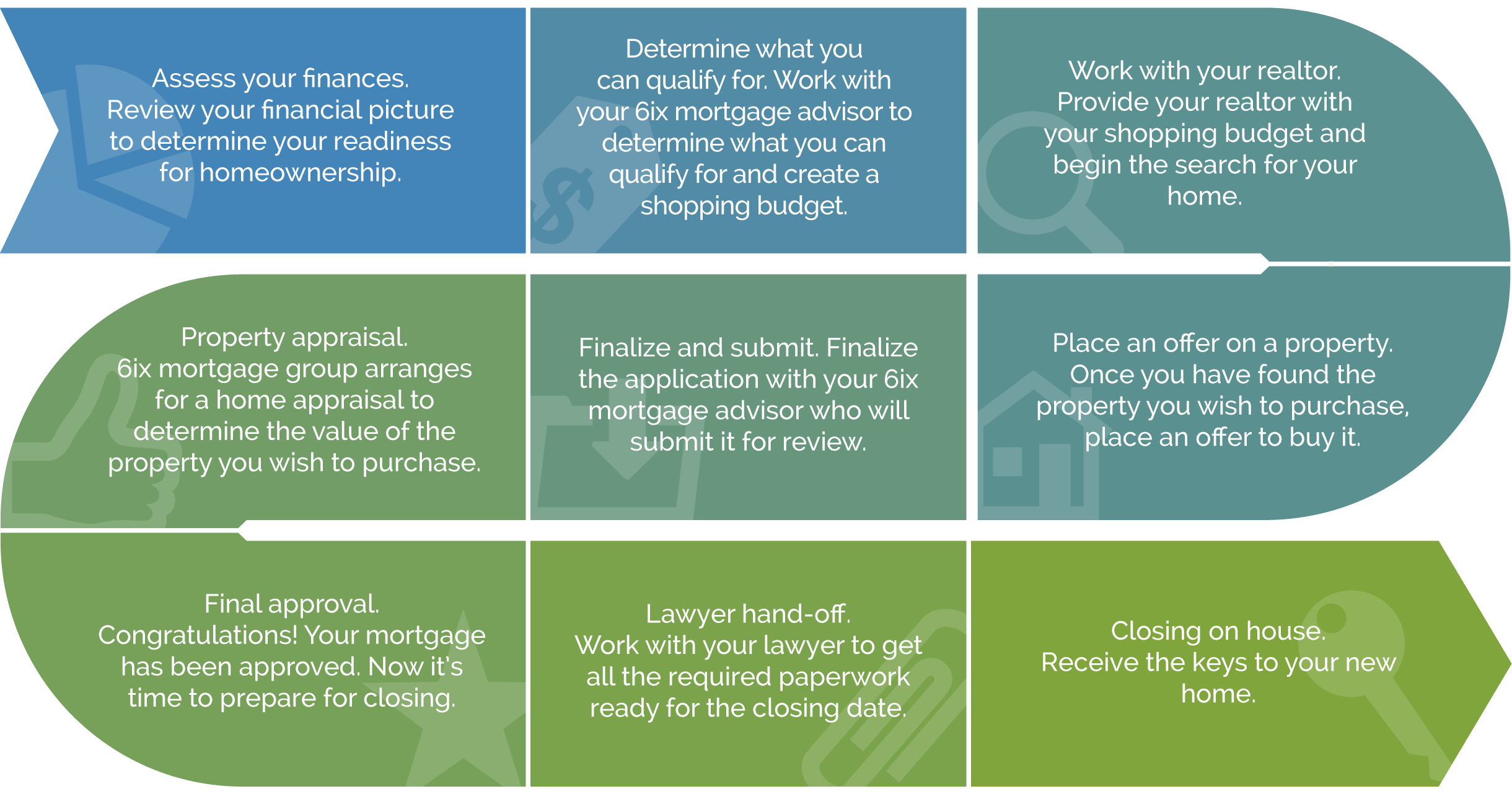

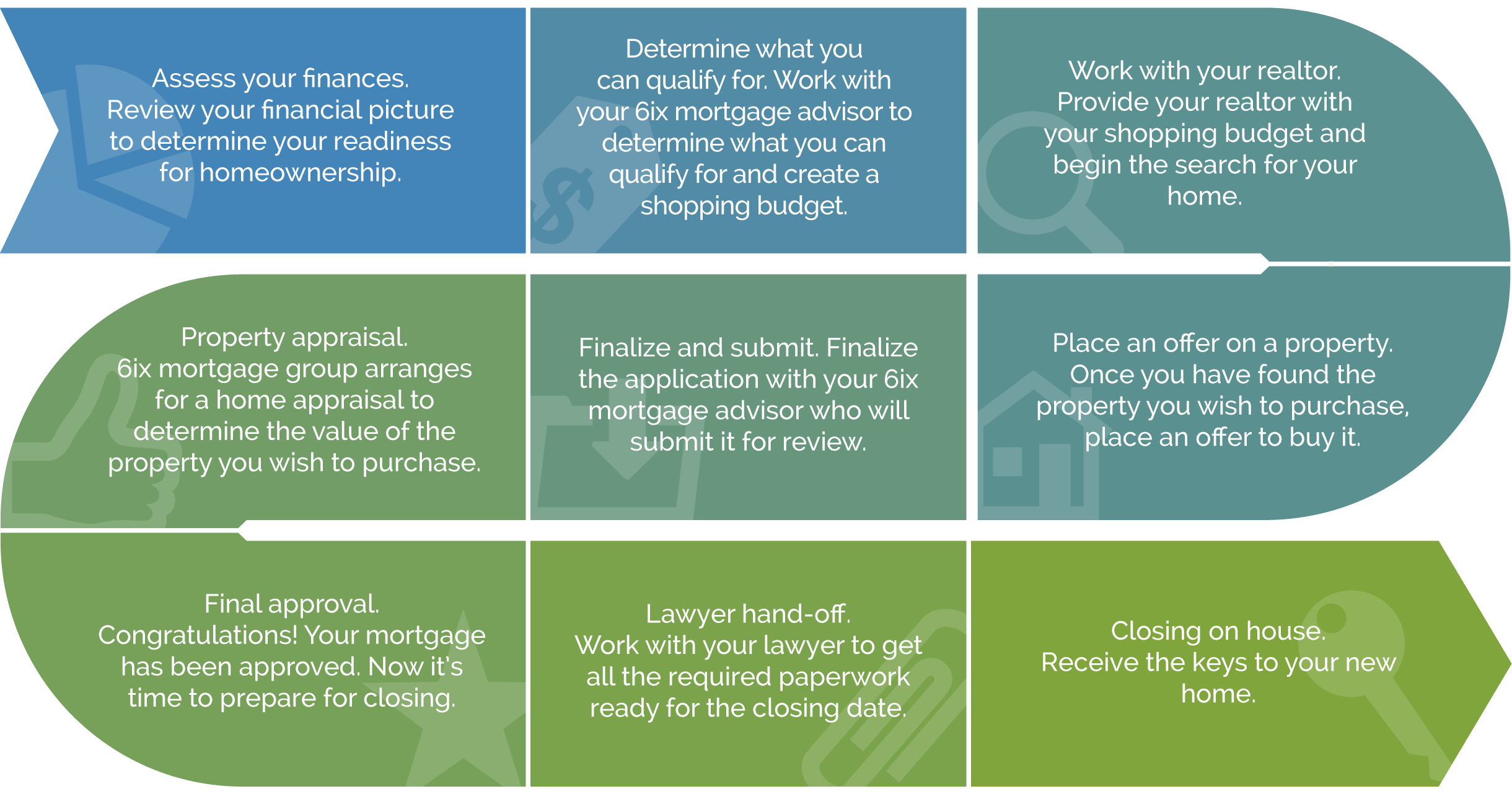

THE HOME BUYING PROCESS

Required Mortgage Documents Checklist

- Current employment and amount of income such as:

- Copy of recent pay slips

- Evidence of recent pay deposited electronically

- T1 General and associated Notice of Assessment (NOA)

- Previous employment (if required)

- Additional income sources (if any)

- Savings or investments statement from within the last 90 days

- Sale of an existing property – a copy of the sale agreement

- Withdrawal from RRSP through the Home Buyer’s Plan, if applicable

- Gift Letter

- A list of current assets and liabilities

- Bank account and transit number for payments

- Your CIBC Pre-Approved Mortgage Certificate, if applicable

- A copy of the real estate listing

- A copy of the accepted purchase and sale agreement

- The property’s full address, including legal description and postal code

- Property tax estimates, condo fees and heating costs, (usually available on the real estate listing)

- For rural properties, well and septic certificates

- Lawyer’s name, address, postal code, telephone and fax number